Limited Documentation and High Debt-to-Income, but High Credit Score and Low Loan-to-Value

Five years have passed since the Consumer Financial Protection Bureau (CFPB) issued regulations to provide safer and more sustainable home loans for consumers, known as Qualified Mortgages (QMs).[1] The Dodd-Frank Wall Street Reform and Consumer Protection Act imposed an obligation on lenders to make a good-faith effort to determine that the applicants have the ability to repay the mortgage. This is known as the ability-to-repay (ATR) rule. The Act also mandates that QM loans cannot have risky loan features like negative amortization, interest-only, balloon payments, terms beyond 30 years or excessive points and fees. QM loans must also satisfy at least one of the following three criteria:

- Borrower’s debt-to-income (DTI) ratio is 43 percent or less

- Loan is eligible for purchase, guarantee or insurance through the Federal Housing Administration, Veterans Affairs, United States Department of Agriculture or a government-sponsored enterprise (GSE), regardless of the DTI ratio

- Loan was originated by insured depositories with total assets less than $10 billion and must be held in portfolio for at least three years.

Any home loan that doesn’t comply with the QM rules is called non-QM. A non-QM loan is not necessarily a high-risk loan, it’s merely a loan that doesn’t meet the QM standards. Examples of a non-QM loan include interest-only or limited/alternative documentation loans. A non-QM loan still needs to satisfy the ATR requirements.

The non-QM market is expanding (up by 1 percentage point from 2017 to 2018) and represented about 4 percent of 2018 originations. Although the non-QM market is just a small piece of today’s mortgage market, it plays a key role in meeting the credit needs for homebuyers who are not able to obtain financing through a GSE or government channels. Creditworthy borrowers not applying for GSE or government-insured loans may benefit from non-QM options. These may include self-employed borrowers, first-time homebuyers, borrowers with substantial assets but limited income, jumbo loan borrowers and investors.

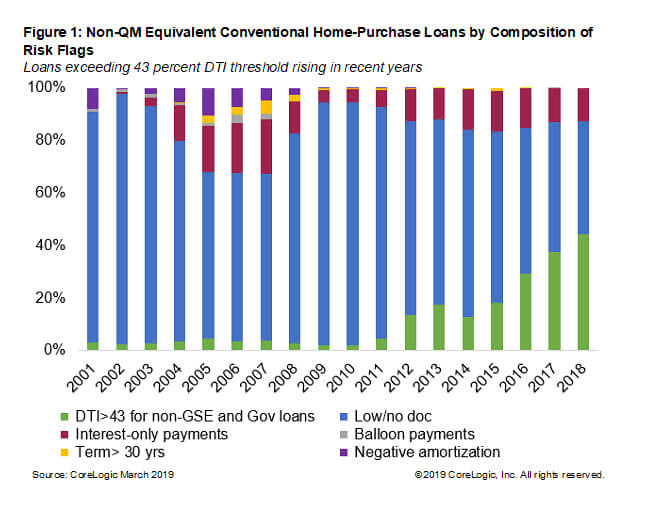

Figure 1 compares the non-QM equivalent loans from 2001 to 2018 by composition of six major risk features.[2] All conventional home-purchase loans not meeting at least one of these six QM-mandated criteria were included.[3] The three main reasons why non-QM loans that originated in 2018 failed to fit in the QM box were use of limited or alternative documentation, DTI above 43 percent and interest-only loans. Almost 46 percent of the non-QM borrowers exceeded 43 percent DTI threshold, 44 percent used limited or alternative documentation and 13 percent of the non-QMs were interest-only loans. Share of non-QM loans exceeding 43 percent DTI threshold has increased by more than three times in 2018 compared with 2014. However, some of the riskier factors such as negative amortization and balloon payments have completely vanished.

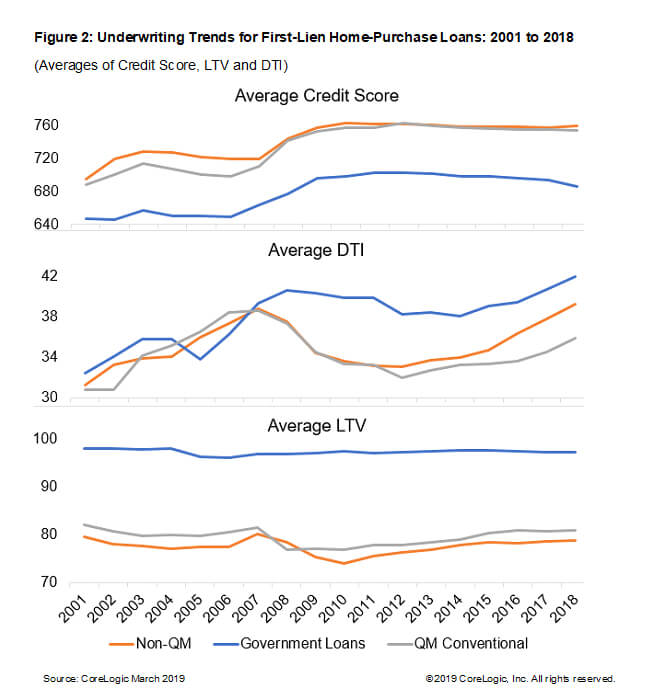

Today’s non-QMs are high quality. They are vastly different and safer than their pre-crisis counterparts. Figure 2 shows the trend of three major variables of underwriting for first-lien home purchase loans: credit score, DTI and loan-to-value (LTV) ratio. In 2018, the average credit score of homebuyers with non-QMs was 760, compared to a score of 754 for homebuyers with QMs. Similarly, the average first-lien LTV for borrowers with non-QMs was 79 percent compared to 81 percent for borrowers with QMs. However, average DTI for homebuyers with non-QMs was higher compared with the DTI for borrowers with QMs.[4]

Despite having DTI ratios that are higher than conventional QM loans today, non-QMs are performing very well. Both the non-QM and QM conventional loans had low delinquency rates in 2018. In fact, the serious delinquency rate for non-QM loans is slightly lower than the rate for conventional QM loans and government-insured loans in 2018. Lenders are using high credit score and low LTV to help offset the added risk from high DTI, limited documentation and interest-only non-QM loans.

[1] QM regulation went into effect in January 2014.

[2] QM regulations were used to identify pre-2014 non-QM equivalent loans.

[3] Only conventional loans with valid values for the variables needed to identify QM loans were included.

[4] DTI for “non-QM equivalent” is likely too low in 2005-2006 or missing many high DTI observations.

© 2019 CoreLogic, Inc. All rights reserved.