Home equity up $51,000 last year for average homeowner with a mortgage

Home equity – the difference between the value of a home and the amount of mortgage debt on the home – is an important component of overall household wealth. Changes in the amount of home-equity wealth will be primarily affected by growth in home values and pay down of mortgage loan balances. For the last few years, home-value appreciation has been the major creator of wealth.

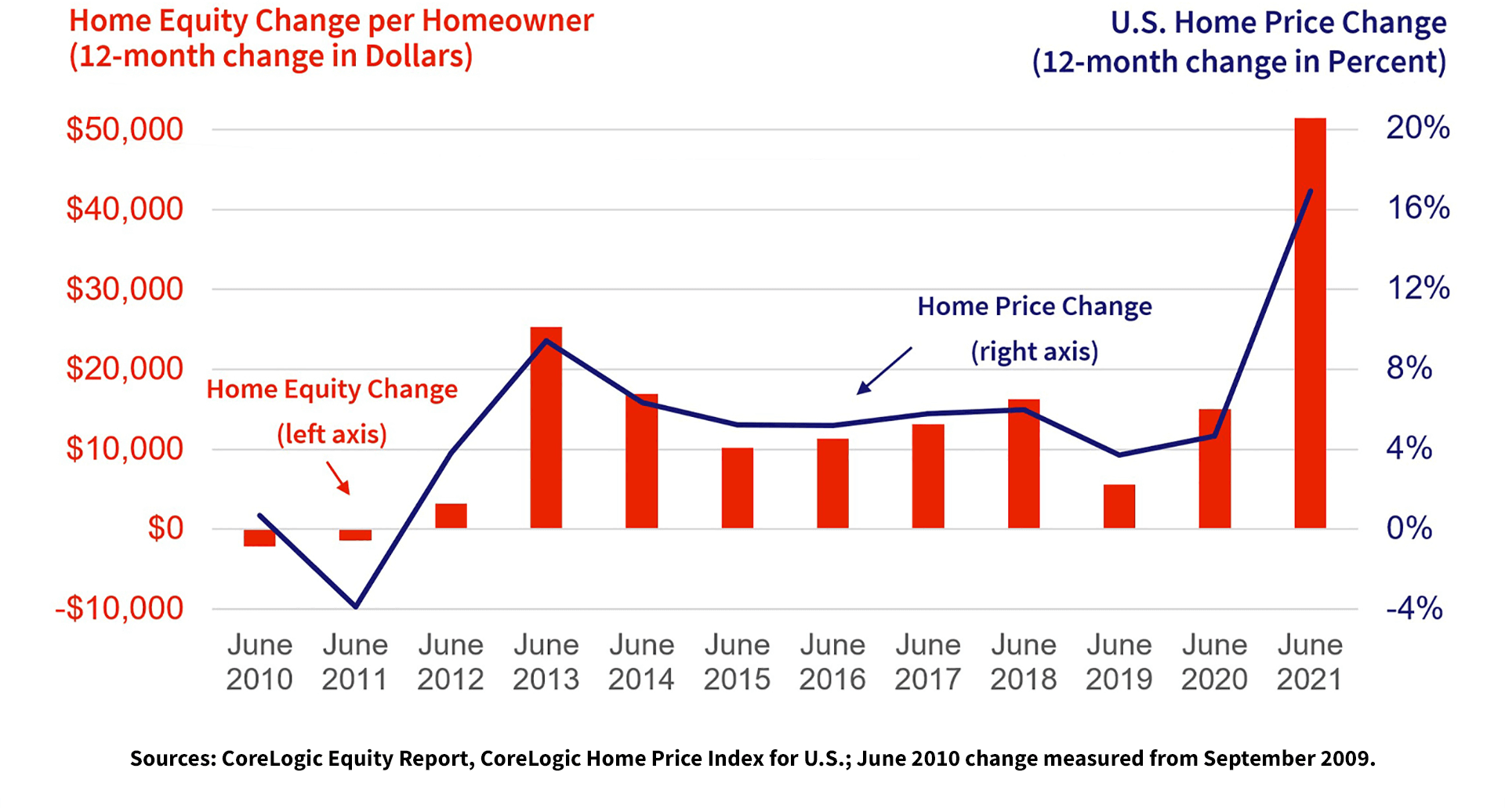

Figure 1: Home Price Growth Drives Equity Wealth Creation

The national CoreLogic Home Price Index reported annual growth of 18% in July, the largest increase recorded in its 45-year history. Likewise, home-equity wealth rose a record amount during the past year.

The latest CoreLogic Home Equity Report found that the average homeowner gained about $51,000 in home-equity wealth during the year ending June 2021, with larger gains in areas that were high-cost and had faster appreciation.

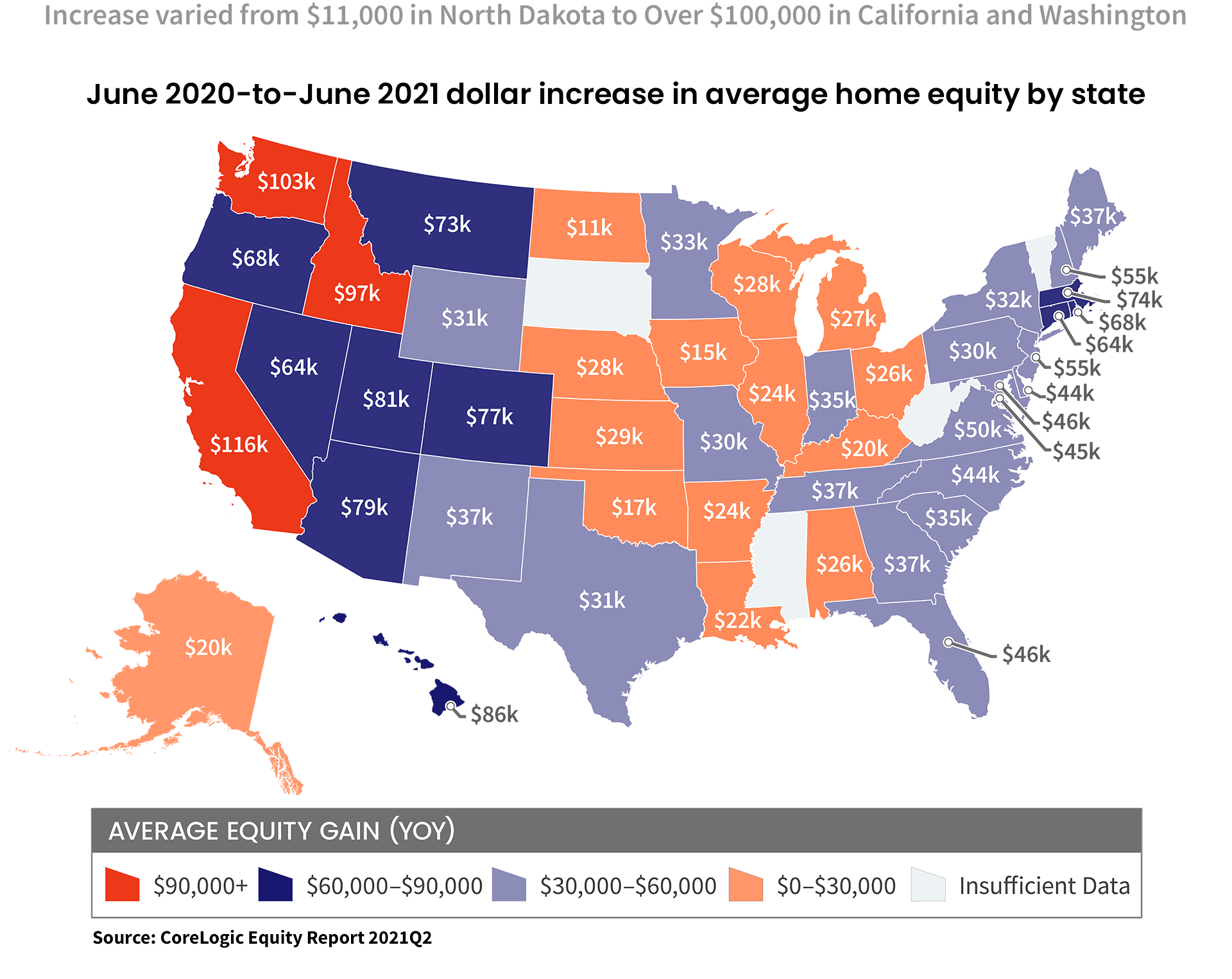

Figure 2: Home Equity Rose an Average $51,000 Last Year

For example, the average homeowner in California and Washington had a wealth gain of just over $100,000, reflecting the high price of homes and rapid appreciation. In contrast, the average owner in North Dakota gained just $11,000 in their housing wealth, given the much lower prices and more modest price growth.

Higher wealth spurs additional consumption spending. While estimates vary, IHS Markit analysis indicates that last year’s home-equity wealth gain could lead to an average $1,500 per household in additional consumption spending over the next couple years, or about $120 billion of additional spending summed up across all homeowners.1

Further, home equity may be used as a source of funds to support additions and other investments to an existing home. Home improvement and repair expenditures reached a record amount from this past year, with the Joint Center for Housing Studies projecting a $30 billion increase in spending during the coming year.2

Because of the effect home-equity wealth has on consumption spending and residential investment, these gains in wealth will support further economic growth this year and next.

Summary:

- Home equity wealth increased $51,000 on average for homeowners last year.

- Home price rise is the major cause of home equity increase.

- Communities with high prices or higher price growth had larger home equity gains.

- Home equity gains support future consumption and home investment spending.

1 IHS Markit has estimated a long-run marginal propensity to consume from an increase in wealth of about 3 percent, implying a $51,000 increase in wealth will lead to a $1,500 increase in consumption spending per homeowner over time. The American Community Survey reported about 79 million homeowners during 2019, implying about $120 billion in aggregate spending.

2 The Bureau of Economic Analysis reported a record $291 billion in residential improvements during 2020. The Joint Center for Housing Studies also reported a record $352 billion in homeowner improvement and repair spending for the year running from mid-2020 to mid-2021 and forecast an 8.6% rise through mid-2022 (https://jchs.harvard.edu/research-areas/remodeling/lira ).