Introduction

The CoreLogic Loan Performance Insights report features an interactive view of our mortgage performance analysis through May 2022.

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

The report is published monthly with coverage at the national, state and Core Based Statistical Area (CBSA)/Metro level and includes transition rates between states of delinquency and separate breakouts for 120+ day delinquency.

“Early-state mortgage delinquencies are at a generational low supported by a strong labor market. Furthermore, serious delinquencies have declined to where they were in early 2020. While the foreclosure rate remains low, about half of serious delinquencies are from mortgages that are six months or more past due. This suggests that there could be small increases in the foreclosure rate later this year.”

– Molly Boesel

Principal Economist for CoreLogic

30 Days or More Delinquent – National

In May 2022, 2.7% of mortgages were delinquent by at least 30 days or more including those in foreclosure. This represents a 2-percentage point decrease in the overall delinquency rate compared with May 2021.

Mortgage Delinquencies Drop to 23-Year Low

The U.S. overall mortgage delinquency rate declined for the 14th consecutive month on an annual basis in May to the lowest level recorded since January 1999. While the national foreclosure rate remained flat year over year and month over month, the rate did have a small monthly uptick in March of this year. However, it too remains near a historic low. As in previous months, home price growth and the resulting equity accumulation helped keep foreclosure rates low in May, with year-over-year appreciation topping 20% this spring.

Loan Performance – National

CoreLogic examines all stages of delinquency to more comprehensively monitor mortgage performance.

The nation’s overall delinquency rate for May was 2.7%. The rate for early-stage delinquencies – defined as 30 to 59 days past due – was 1.1% in May 2022, down from May 2021. The share of mortgages 60 to 89 days past due was 0.3%, unchanged from May 2021. The serious delinquency rate – defined as 90 days or more past due, including loans in foreclosure – was 1.3%, down from 3.2% in May 2021.

As of May 2022, the foreclosure inventory rate was 0.3%, unchanged from May 2021.

Transition Rates – National

CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

The share of mortgages that transitioned from current to 30-days past due was 0.6%, down from May 2021.

Overall Delinquency – State

Overall delinquency is defined as 30-days or more past due, including those in foreclosure.

In May 2022, all states logged year-over-year declines in their overall delinquency rates. The states with the largest declines were Nevada (down 3.2 percentage points), New York, New Jersey and Hawaii (all down 3.1 percentage points).

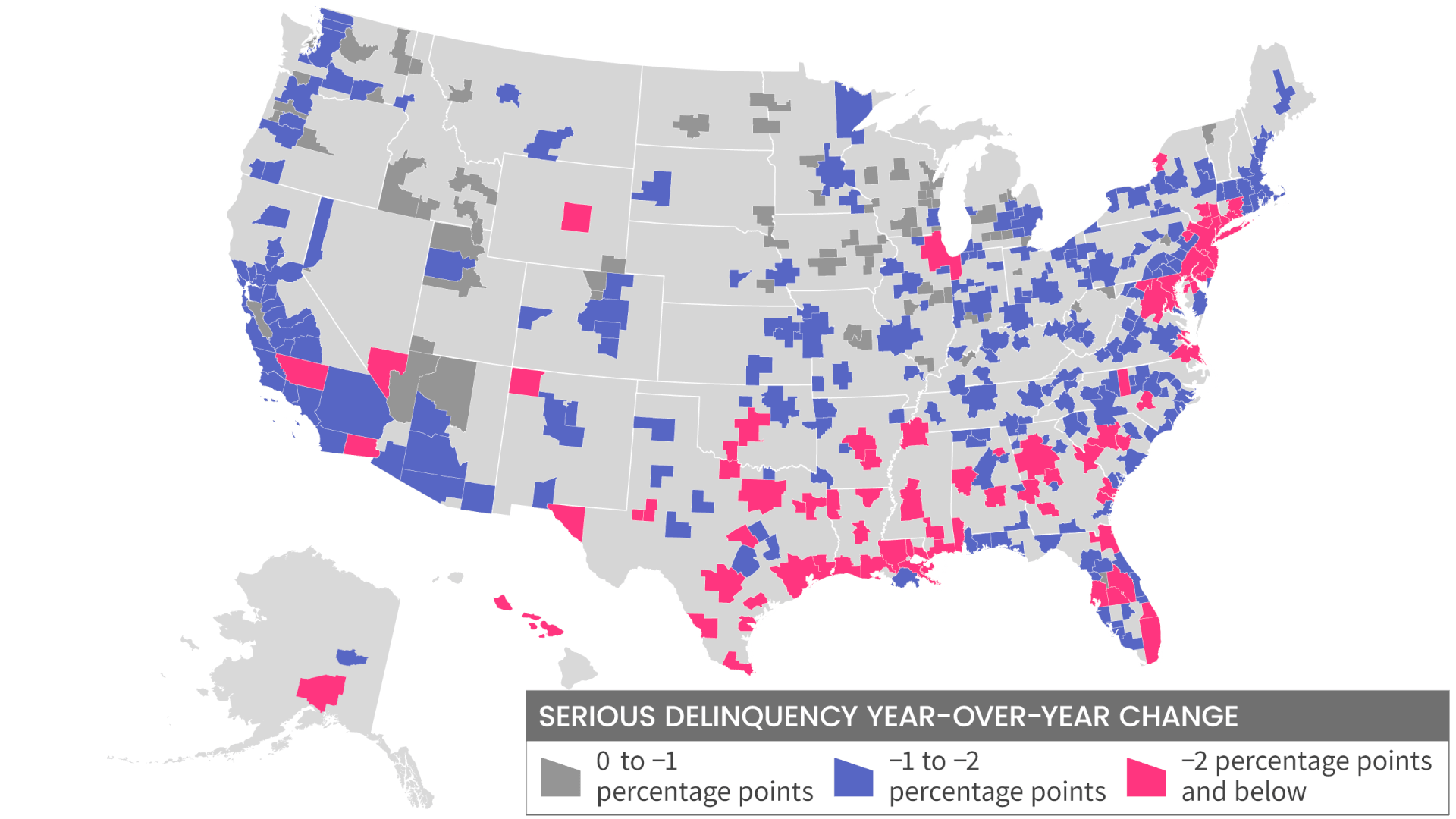

Serious Delinquency – Metropolitan Areas

Serious delinquency is defined as 90 days or more past due including loans in foreclosure.

There were no metropolitan areas where the Serious Delinquency Rate increased.

There were 384 metropolitan areas where the Serious Delinquency Rate decreased.

Summary

Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next.

For ongoing housing trends and data, visit the CoreLogic Insights Blog: corelogic.wpengine.com/insights.

CoreLogic Insights – On the Go or Download Apple App Store or Google play

Methodology

The data in the CoreLogic Loan Performance Insights report represents foreclosure and delinquency activity reported through May 2022. The data in this report accounts for only first liens against a property and does not include secondary liens. The delinquency, transition and foreclosure rates are measured only against homes that have an outstanding mortgage. Homes without mortgage liens are not subject to foreclosure and are, therefore, excluded from the analysis. Approximately one-third of homes nationally are owned outright and do not have a mortgage. CoreLogic has approximately 75% coverage of U.S. foreclosure data.

Source: CoreLogic

The data provided are for use only by the primary recipient or the primary recipient’s publication or broadcast. This data may not be resold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data are illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact Robin Wachner at [email protected]. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. The data are compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic is a leading global property information, analytics and data-enabled solutions provider. The company’s combined data from public, contributory and proprietary sources includes over 4.5 billion records spanning more than 50 years, providing detailed coverage of property, mortgages and other encumbrances, consumer credit, tenancy, location, hazard risk and related performance information. The markets CoreLogic serves include real estate and mortgage finance, insurance, capital markets, and the public sector. CoreLogic delivers value to clients through unique data, analytics, workflow technology, advisory and managed services. Clients rely on CoreLogic to help identify and manage growth opportunities, improve performance and mitigate risk. Headquartered in Irvine, Calif., CoreLogic operates in North America, Western Europe and Asia Pacific. For more information, please visit corelogic.wpengine.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries.

Contact

For more information, please email Robin Wachner at [email protected]