Home / Mortgage / Mortgage Origination Solutions / LoanSafe

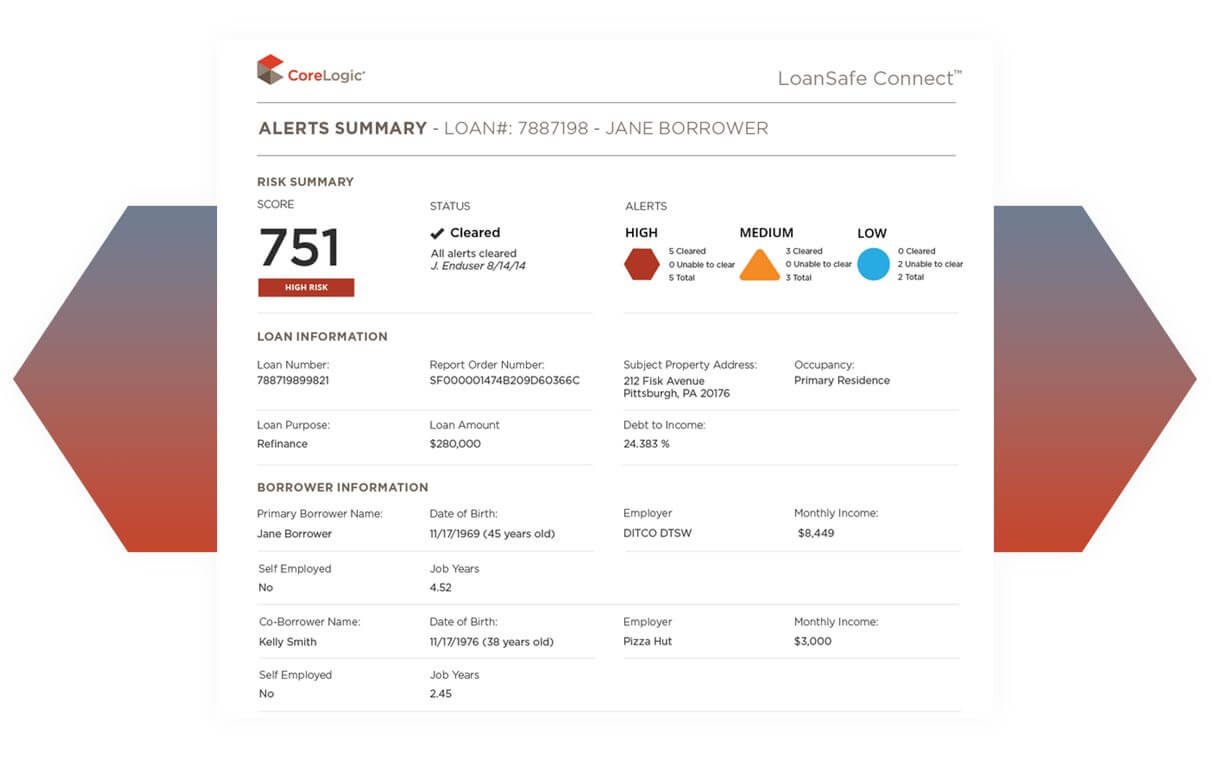

Fueled by the only mortgage fraud consortium with over 100 million loan applications, patented recognition models with known fraud outcomes, and CoreLogic’s vast repository of property data, our LoanSafe solution is the gold standard of fraud risk detection tools. Data from CoreLogic’s Fraud Consortium helps generate predictive fraud models, develop industry and lender-level benchmarking standards, and identify common fraud characteristics and scheme adaptations.

Corelogic surveyed LoanSafe users to gauge how well the product suite helps them pinpoint loans with the highest risk of fraud

Delivering valuable resources

Automatic, multi-faceted risk detection

CoreLogic’s years of experience in analyzing fraud patterns allows us to provide predictive, analytic-based scores that you can use to categorize loans based on the relative likelihood fraud was involved in the application process. For example, in a group of loans analyzed using our powerful detection tools, approximately 60% of those involving fraud will be scored in the top 10%. Our access to vast, high-quality data makes it possible for us to deliver predictive insights like this — which can help you keep your resources focused and effective.

LoanSafe Explorer™ analyzes your entire portfolio for fraud schemes that may be missed in a loan-level review. This add-on service provides continuous monitoring that proactively identifies emerging patterns that can help you reduce the risk of large losses and unsalable loans.