Proactive assessment of future risk is a cost-effective business practice

In March 2024, the U.S. Securities and Exchange Commission (SEC) issued climate-related risk disclosure requirements. Although there has since been a stay on the guidance, the insurance industry should still prepare for the material impact that a reinstatement of the rules would produce since natural catastrophes and climate-related risks are integral components in carrier risk management strategy.

Insurers can — and should — be prepared for potential future climate risk disclosure requirements. By proactively reevaluating risk assessment strategies, carriers can be one step ahead of their competition.

New disclosure rules may require carriers to reassess which geographic areas are most heavily exposed in their portfolios and whether these areas experience weather-related perils affected by climate change.

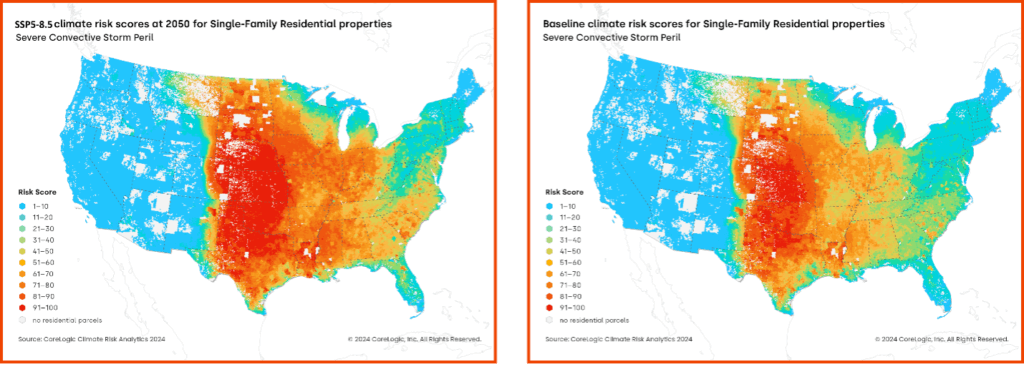

For example, there is a link between a warmer climate and the number of days that are favorable for SCS activity. The warmer the climate, the more frequent severe storms can be and the longer the SCS season can run. In fact, U.S. severe convective storm (SCS) activity in 2023 and 2024 proved to be a significant risk driver in the U.S., affecting most states east of the Rocky Mountains.

Understand the Future of Physical Risk

The Benefits of Being Proactive in the Face of Future SEC Climate Risk Disclosure Rules

By being proactive, insurers can gain a competitive edge.

If they wait, insurers may find that they have undesired exposure to risks from unforeseen events like natural disasters, as well as potential regulatory non-compliance.

Organizations need both the tools and a plan to conduct a comprehensive risk evaluation of climate impacts. This is not an easy task.

Insurers stand to benefit immensely from access to climate change-conditioned probabilistic models, granular property characteristics, accurate replacement cost estimates, and natural hazard analytics. These tools and data sources are integral to building robust risk assessments for both the current and the future climate.

The Risk Managers Tool Kit: Climate Risk Analytics™

Imagine a regional residential property insurer that writes in the Great Plains region and has a heavy focus in Ohio and Illinois. Today, the carrier’s disciplined underwriting strategy and operational efficiency ensures solvency and profitability, but SCS activity is expected to increase as the climate warms (Figure 1).

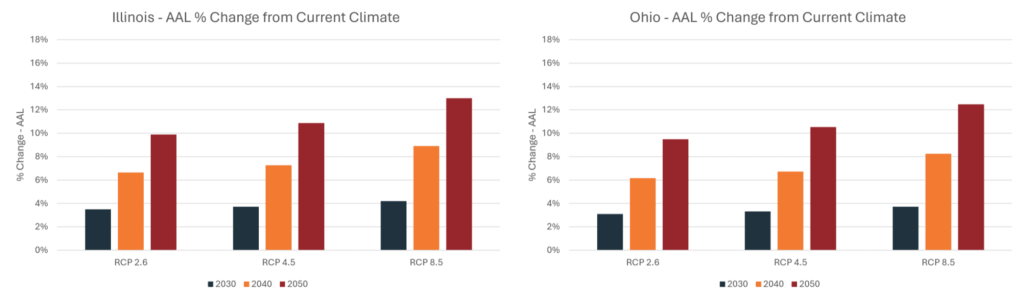

The insurer — using the climate-conditioned SCS catastrophe model within CoreLogic’s CRA — calculates that by 2030, their state-level average annual loss (AAL) in Illinois and Ohio will increase by 4% and 3%, respectively under the moderate representative concentration pathways (RCP) scenario (RCP4.5). By 2050, SCS AALs in those states will increase by 11%. The scenario is even more extreme under RCP8.5 (Figure 2).

Compliance with regulatory requirements may require carriers to disclose these physical climate-related risks as well as their strategies to mitigate future physical risk.

CoreLogic has developed a suite of Climate Risk Analytics™ (CRA™) tools for insurers to assess their current-day risk portfolios under multiple future climate scenarios and timeframes. By modeling future climate risks, insurers can anticipate and adapt to changing regulatory requirements as well as a changing climate.

CRA quantifies portfolio- and property-level average annual loss and probable maximum losses (PML) under multiple representative concentration pathways and across multiple time horizons (e.g., 2030, 2040, and 2050).

These metrics not only assist insurers in gaining an understanding of the physical risks resulting from climate change, but they also provide the information which may be necessary to satisfy the SEC’s regulatory compliance requirements.

The Road Ahead

The property risk landscape across the U.S. is shifting. Climate change will increase the frequency, severity, and geographic distribution of certain perils. As such, more federal regulations aimed at ensuring future economic stability in the U.S. would not be surprising.

To help enterprises prepare for that future, CoreLogic remains a committed data provider and partner for those wishing to reduce the uncertainty that accompanies a shifting property risk landscape.

Understand the Future of Physical Risk

©2024 CoreLogic, Inc. All rights reserved. While all of the content and information is believed to be accurate, CoreLogic makes no guarantee, representation, or warranty, express or implied, including but not limited to as to the completeness, accuracy, applicability, or fitness, in connection with the content or information or the products or the regulations referenced herein and assumes no responsibility or liability whatsoever for the content or information or products or regulations referenced herein or any reliance thereon. CoreLogic®, Climate Risk Analytics™, and CRA™ are the trademarks of CoreLogic, Inc. or its affiliates or subsidiaries.