Robust home price growth, which averaged 5.7% nationally over the last year according to the CoreLogic Home Price Index , drove equity of America’s homeowners with a mortgage up by more than $1.5 trillion. Added together across all homeowners in the U.S., home equity has grown more than $12 trillion since its low point during the Great Recession.

This is good news for homeowners —but the situation is a little trickier when it comes to how that $12 trillion is spread, and which of those homeowners are currently in a stage of forbearance. For families who have a low amount of equity and are in forbearance, the risk of losing their home becomes higher.

Examining the Equity Situation

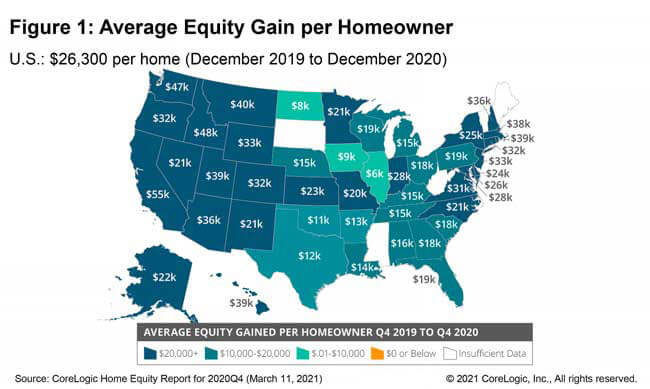

According to the CoreLogic Home Equity report , the average homeowner gained more than $26,000 in home equity during 2020. Home equity gains varied across the country as some areas saw stronger appreciation rates and new mortgage debt via home purchases and refinances.

Homeowners in California, Idaho and Washington state saw double the equity gains over the year, averaging about $50,000, reflecting vigorous appreciation and higher home values in those areas. To contrast, homeowners in North Dakota, Iowa and Oklahoma averaged about $9,000 in equity gains over the year. Figure 1 illustrates equity gains over the year by state.

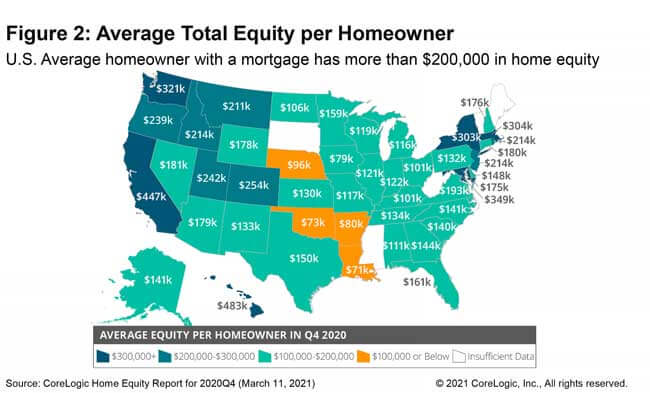

With steady home price growth since 2012, the average total home equity per borrower is even higher the longer the homeowner has owned the home and the lower their remaining loan balance is. Nationally, total home equity per borrower was $204,000 at the end of 2020.

This figure does range widely across states and it depends on local prices and the rate of home price appreciation over time. Figure 2 illustrates total average equity per borrower by state. Hawaii ranks first, where the average borrower has almost half a million dollars in home equity. In contrast, the Louisiana borrower has the least amount of equity, averaging little over $70,000 per borrower, which makes Louisiana borrowers particularly vulnerable in light of state’s high rate of forbearances.

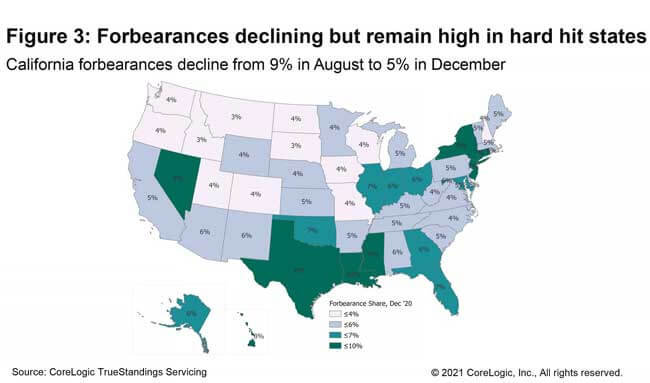

At 10%, Louisiana has the highest rate of forbearances, but the rates are also elevated in Nevada, Texas, New York and Hawaii, all of which are at 8% and higher, as shown in Figure 3. Generally, forbearances reflect large pandemic-related employment losses in leisure and hospitality sectors, particularly in Nevada. It also reflects job losses in the oil industry, especially due to the devastating hurricanes that affected the Gulf Coast last summer. As a result, areas in Louisiana and Texas have seen spikes in mortgage defaults and forbearances.

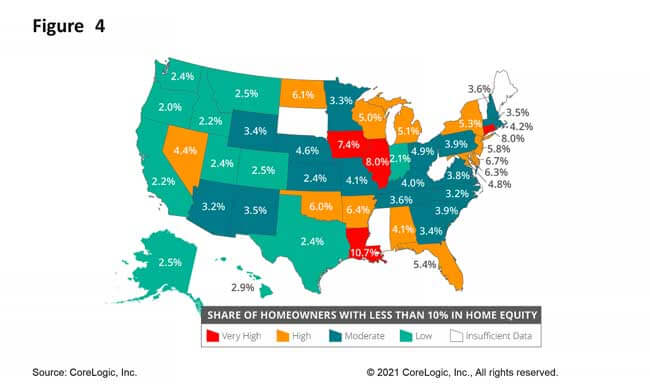

Lastly, while home equity is critically important in loss mitigation policies and potential distressed outcomes for borrowers who could not keep up with their payments, borrowers would generally need to have 10% or more equity in their homes to cover the transaction cost of selling their home plus additional equity to cover the missed payments. Again, the distribution of home equity within each state varies, too, as home buyers have different loan to value (LTV) ratios at the time of purchase and/or have owned their homes for differing amounts of time.

Nationally, only 4% of borrowers have less than 10% of equity in their homes. In Louisiana, however, more than one in 10 borrowers have less than 10% in equity – suggesting that Louisiana borrowers may be at highest risk of distressed sales in coming years.

Figure 4 illustrates the share of homeowners with less than 10% in home equity. In addition, Louisiana, Illinois, Connecticut and Iowa also have a relatively higher share of homeowners with less equity to work with in case they need to exit forbearance and sell their homes.

As homeowners begin to exit the forbearance period that was enacted with the passing of the CARES Act last year, understanding their equity position is critical in understanding how well homeowners can handle this exit and in preparing for what’s to come.

Fortunately, U.S. economic recovery has shown promising signs including stronger-than-expected consumer spending, stimulus funds and rebound in employment, all of which will help those in financial distress get back on their feet.

© 2021 CoreLogic, Inc., All rights reserved.