Buydowns are now more common in certain western U.S. housing markets

The average 30-year, fixed-rate mortgage has been steadily increasing, recently reaching a 21-year high in August, according to Freddie Mac. [1] This rise in rates presents an additional challenge to the already existing affordability challenges of homeownership. To deal with these rising rates, some borrowers are exploring alternative methods to reduce homeownership costs, such as tapping mortgage buydown points. [2]

Mortgage buydown points temporarily lower monthly payments for the first year or two, making homeownership initially more affordable. However, it’s important to note that a mortgage buydown arrangement translates to only short-term savings on monthly payments.

For example, on a $500,000 loan with the current interest rate of 8%, the resulting monthly payment of approximately $3,670 can be reduced to $3,000 when the short-term rate is lowered to 6%. And while the interest rates using mortgage buydown points are initially lower, they gradually increase over time.

It’s worth mentioning that these buydown points were more common before the Great Recession and have a mixed historical track record. Then, lenders offered buydown points to borrowers who couldn’t otherwise afford or qualify for loans without a complete verification of the ability to pay back the mortgage.

However, today’s mortgages are of a higher quality and lower risk than those originated before the Great Recession, as the 2010 Dodd-Frank Act mandates that borrower qualification not to be solely based on the initial terms. [3] Nevertheless, buyers would be wise to remain aware of their options and should compare loan costs with and without buydown points to suit their financial situations.

Comparing Mortgage Buydown Trends and Share With Interest Rates

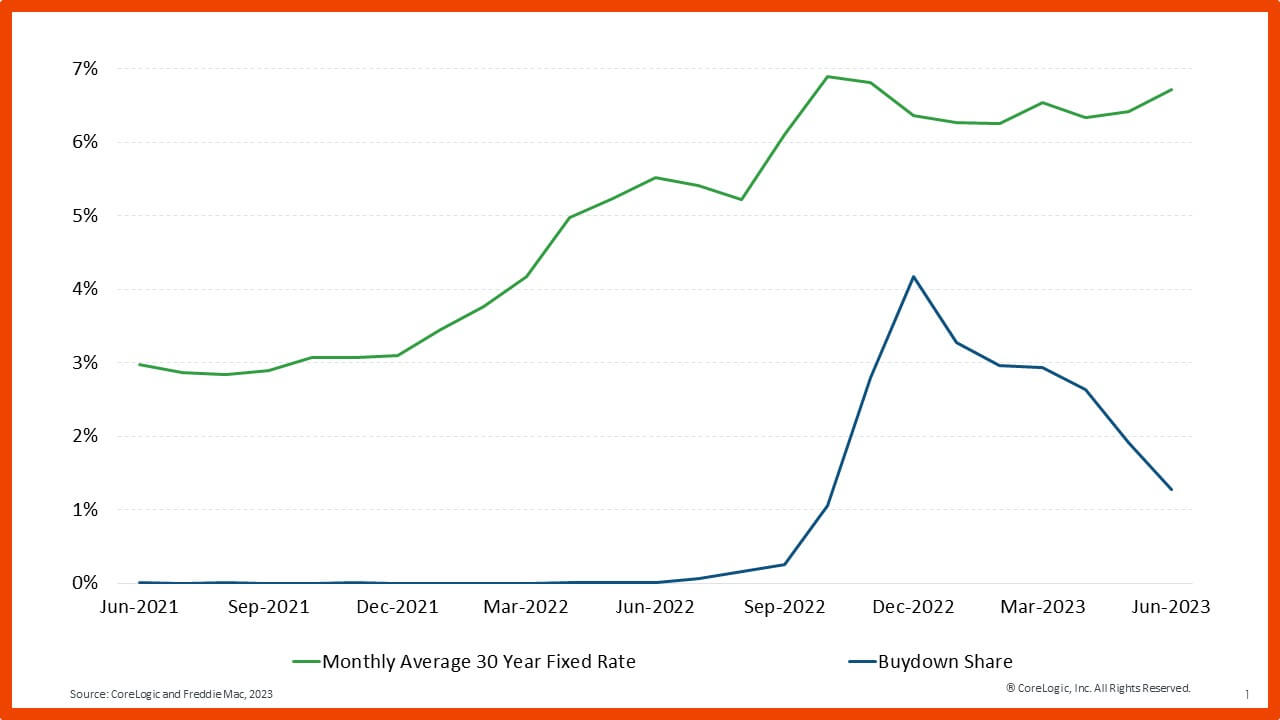

Recently, the popularity of mortgage buydown points has increased. Figure 1 illustrates that buydowns began to rise as the average 30-year, fixed-rate mortgage crossed 6%, with buydown activity peaking in December 2022. [4] However, as interest rates continue to remain elevated, the prevalence of buydowns has started to slowly decline.

Western States Lead for Mortgage Buydown Activity

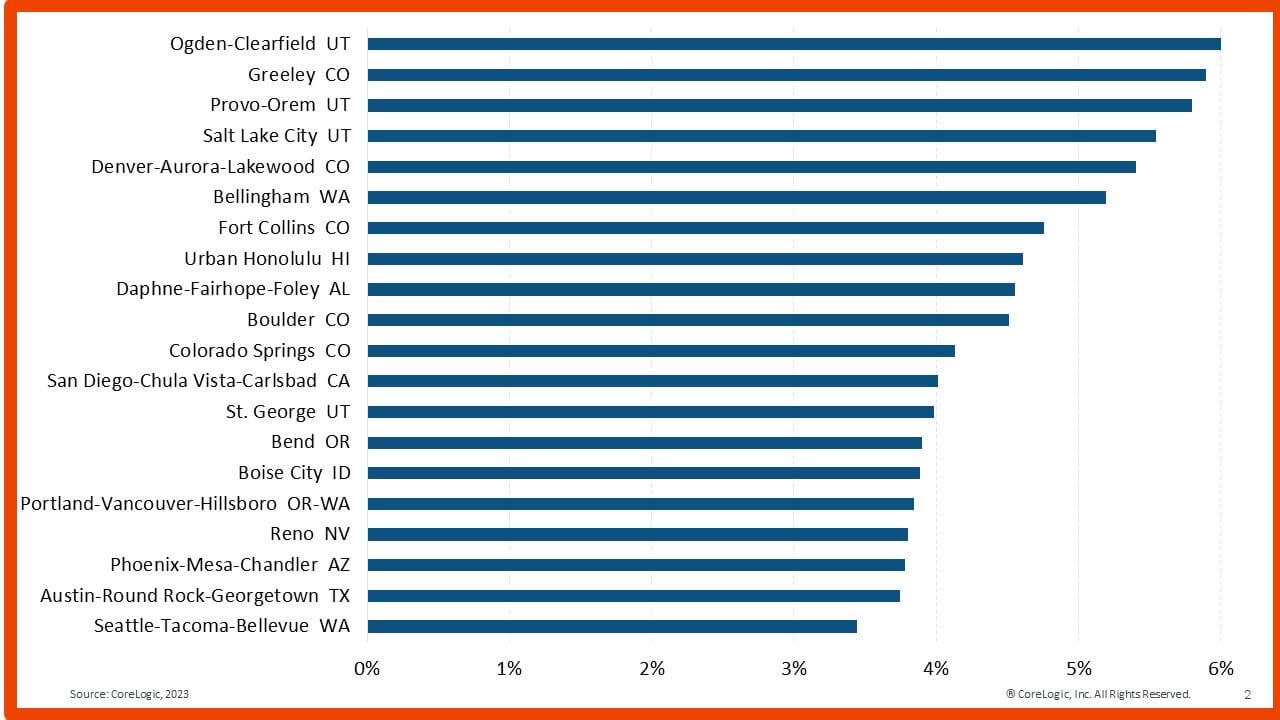

Mortgage buydown points are more common in certain states in the West when compared with other parts of the U.S. Figure 2 shows the top 20 metro areas with the highest share of home loans using buydown points. A greater proportion of mortgage buydown point activity exists in Western metros including those in Utah, Colorado, Washington, Idaho, Nevada and Arizona. Ogden-Clearfield, Utah, had the highest percentage of homebuyers using buydown points (6%), followed by Greeley, Colorado (5.9%); Provo-Orem, Utah (5.8%); Salt Lake City (5.5%) and Denver (5.4%).

In general, borrowers who opt for buydown points tend to have higher interest rates compared with those who do not. Data indicates that homebuyers with mortgage buydown points had an average interest rate that was 17 basis points higher than borrowers without buydown points. It appears that some homebuyers are willing to pay extra to reduce their monthly payments during the initial years of the loan and in the short term.

Though loans with buydown points represent a small segment of today’s mortgage market, they might play a crucial role in making homeownership more affordable for some buyers, at least during the initial years.

Regularly visit CoreLogic’s Office of the Chief Economist’s home page to get the latest housing market data analyses, news and commentary from our team of experts.

[1] Freddie Mac Primary Mortgage Market Survey

[2] Usually, buydown points are paid by homebuilders, lenders and sellers

[3] Consumer Financial Protection Bureau

[4] The share is out of all owner-occupied purchase loans