Housing market prices still only show minor reductions from peak

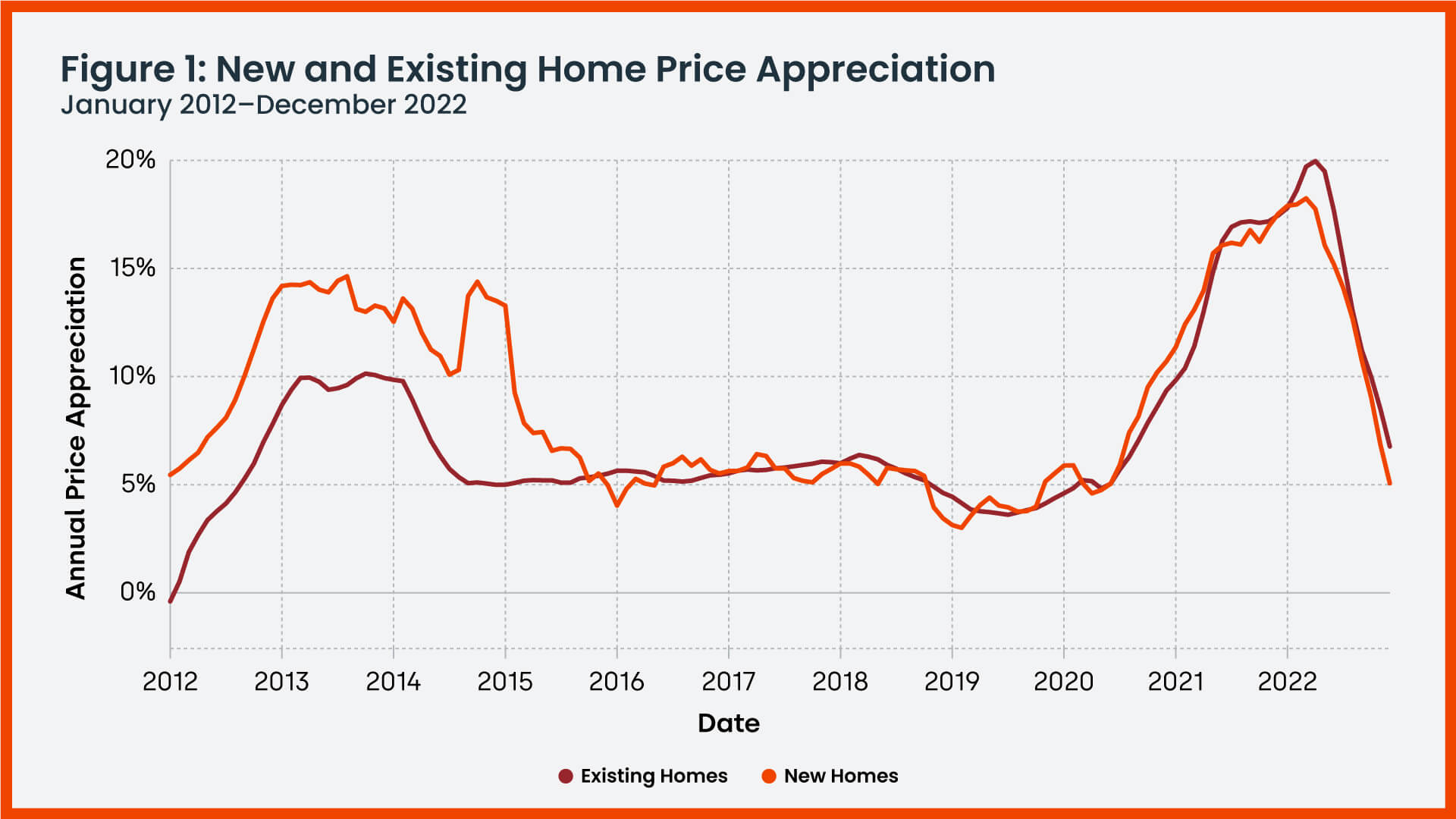

New and existing home prices both declined in 2022. After recording a record high of 18% appreciation in March 2022, annual price appreciation for new homes slowed, dropping to 4% growth by December[1]. Similarly, existing homes reached an annual appreciation peak of 20% in April 2022, but by February, CoreLogic HPI data showed price growth had slowed to 4.4%.

Figure 1 shows that since 2016 there has been little difference between the year-over-year price appreciation for both existing and new homes, although new homes did experience substantially more appreciation a decade ago.

New Home Sales Dip Dramatically

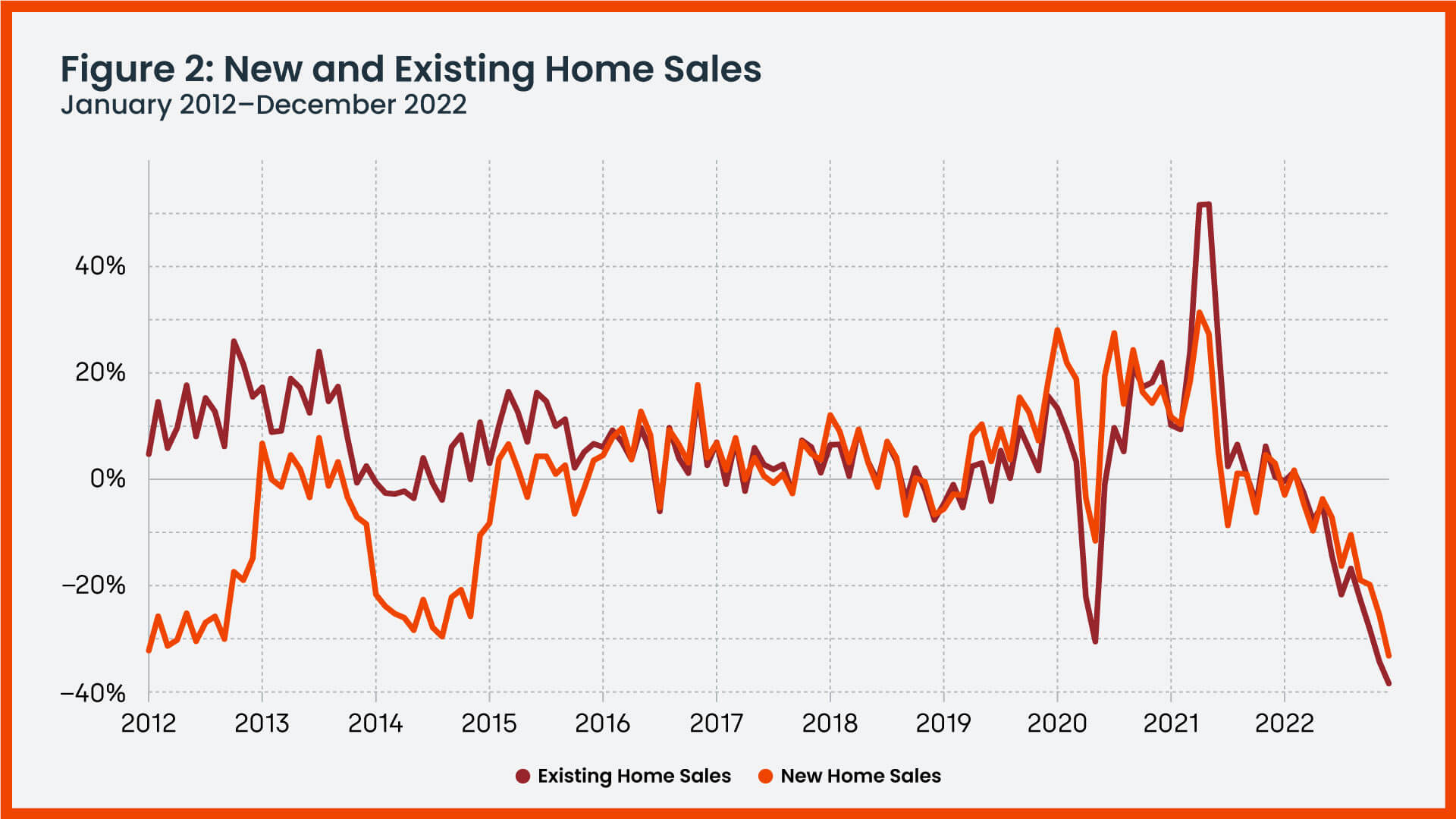

Nationally, new home sales declined every month throughout 2022. However, as the year passed, the decrease became steeper, going from a 5% decline in January to a 38% slide in December.

Existing home sales followed a similar path, with decreases ranging from 2% to 39% over the course of the year. For context, at the height of the shutdown in May 2020, home sales decreased by 12%. The shrinking sales numbers that defined 2022 are unsurprising given the depressed demand fueled by interest rate increases.

Still, the decline in sales volume is much more extreme than the price decline, which is a typical pattern during a downturn. The first half of the 2010s experienced similar decreases in sales when prices were showing very muted growth.

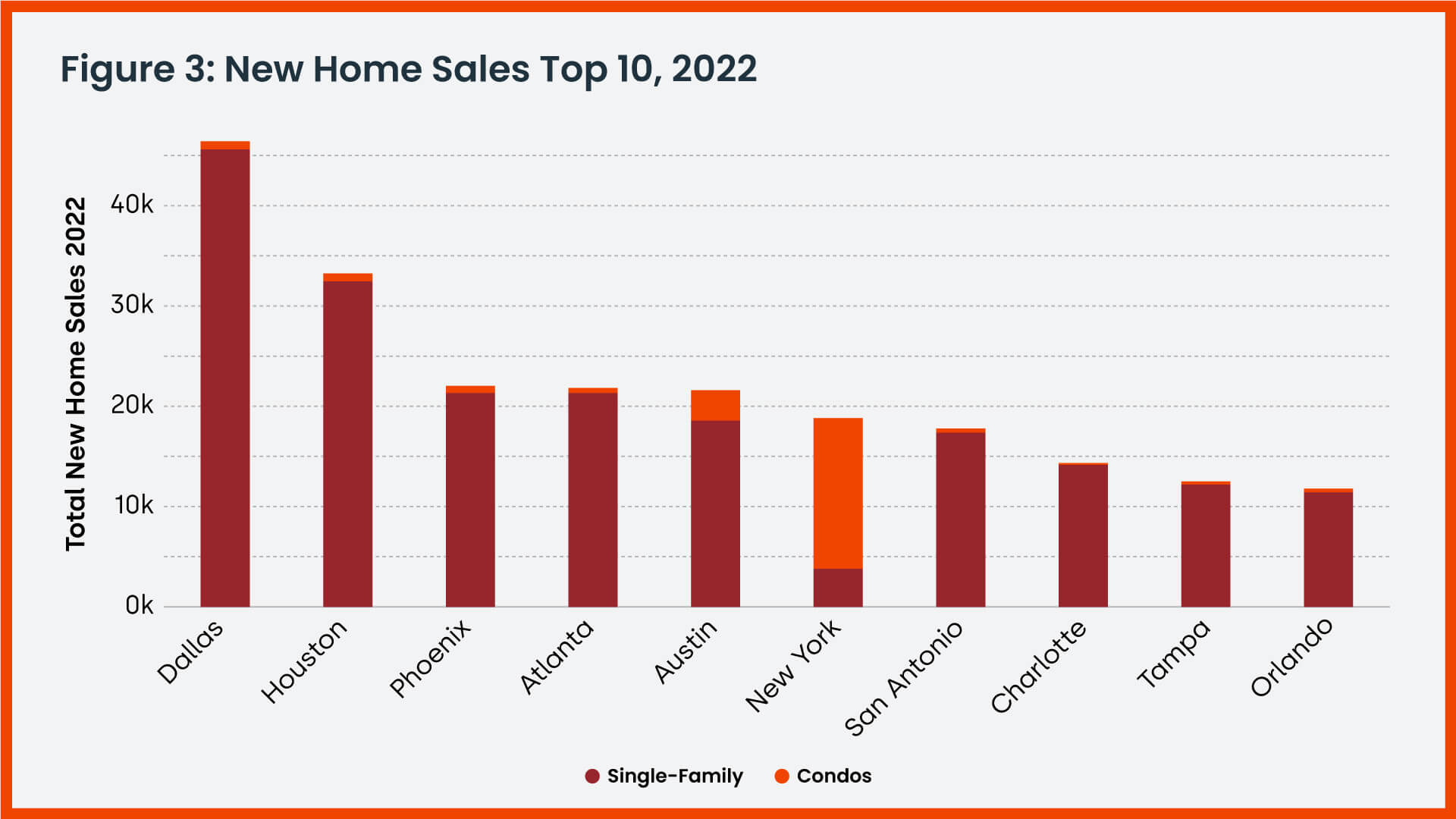

Sales of New Homes Dominate in the South

The top markets for new home sales are primarily located in the South. Dallas and Houston led the list of markets with 46,000 and 33,000 sales respectively. Phoenix was the only metro in the West to remain in the top 10 despite prices falling nearly 10% from their peak.

New York was the only other non-Southern metropolitan statistical area (MSA) to make the list due to the city’s large condo market. Roughly 80% of the 19,000 new home sales in the New York metro las year were condos. For perspective, Austin, Texas, had 3,000 new condo sales, and no other MSA had more than 1,000 such sales. New York produces very few new single-family homes. In fact, if single-family homes were used in this analysis, New York would fall to 33rd place for the number of new home sales, since only 4,000 new single-family homes were sold there in 2022.

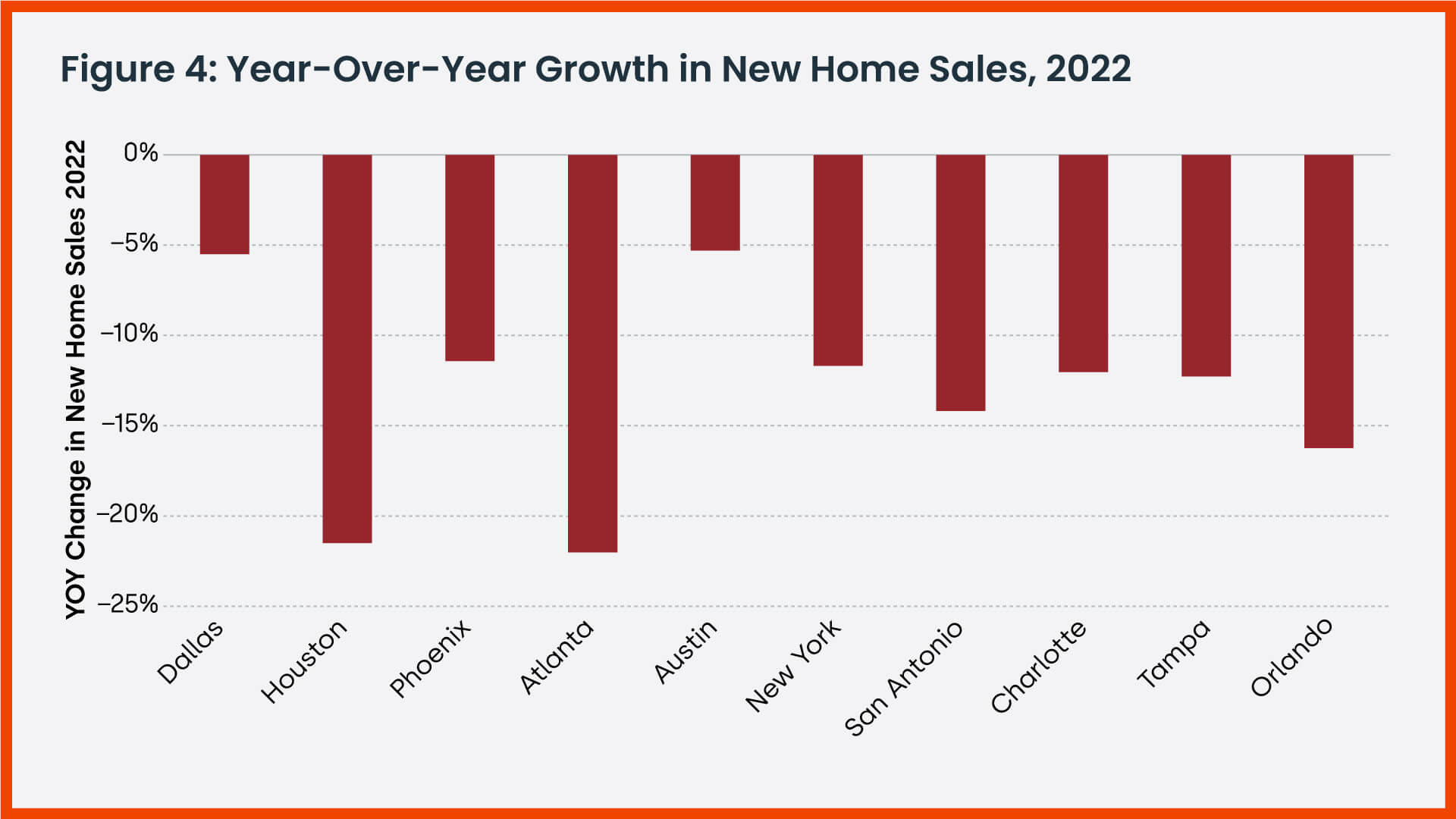

Last year’s drop in sales numbers was widespread. Every MSA in the top 10 saw a decline, ranging from 5% in Austin and Dallas to 22% in Houston and Atlanta. In fact, few locations were insulated from sales declines. Of all 381 tracked U.S. MSAs, only 60 saw an increase in new home sales in 2022. Most of those metros experienced only small increases, with just 20 MSAs having more than 100 additional new home sales in 2022 when compared with 2021.

Overall, conditions seem set for new home sales volumes to remain subdued. Although sales are highly cyclical, prices have historically shown more resilience. While further drops are possible, precedent suggests that prices will slow and stall while developers wait for demand to catch up. However, now that the recent record price increases are no longer offset by low mortgage rates, that demand could take quite some time to ramp up.

[1] Existing home price appreciation uses the CoreLogic HPI https://stage.corelogic.com/intelligence/u-s-home-price-insights/. New home appreciation is the author’s own calculation using a hedonic methodology detailed in https://stage.corelogic.com/intelligence/which-increased-more-new-or-existing-home-prices/.