Generation Z is entering the housing market but currently at a much slower pace than millennials

For the past eight years, millennials have accounted for the largest share of home purchase mortgage applications. According to the CoreLogic Loan Application Database [1], the millennial home purchase share has steadily increased since 2015, rising by about 2 to 3 percentage points per year (Figure 1) [2]. The millennial homebuyer share reached its highest rate in 2022, comprising about 54% of overall home loan applications.

At the same time, Gen Z — the generation following millennials and generally born after 1997 — is now entering the housing market. In 2023, this generation accounted for about 7% of overall home purchase applications.

Millennials Have Led Home Purchase Applications Since 2016

Note: Birth years are used as: Generation Z, born after 1997; millennials, born 1981-1997; Generation X, born 1965-1980; baby boomers, born 1946-1964; Silent Generation, born before 1946

The share of millennial first-time homebuyer (FTHB) mortgage applications is even higher than that of overall home purchase applications for that generation, a figure that comprises both FTHBs and repeat buyers. Millennials accounted for about 68% of all FTHB home purchase applications in 2023, a pattern that is not surprising, as the largest portion of this generation has approached the peak age of typical FTHBs.

Gen Z, the youngest homebuying group, accounted for 15% of FTHB purchase applications in 2023, up by 5 percentage points from 2022. This share is likely to increase in the coming years.

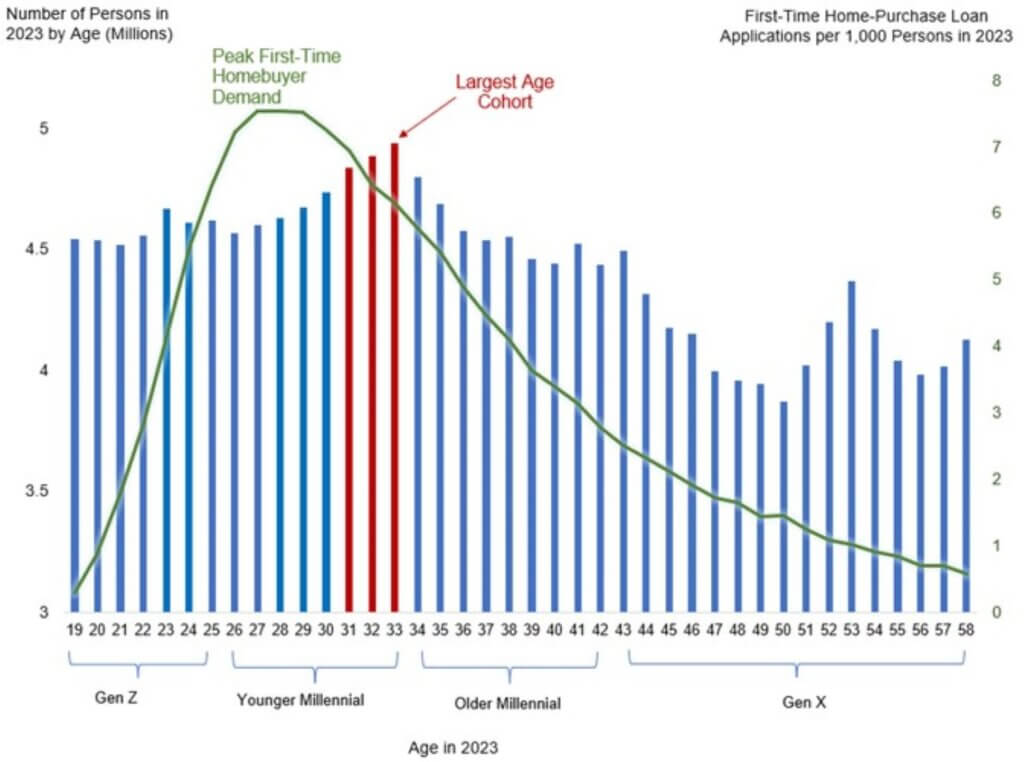

Figure 2 shows the U.S. population distribution by age, with the left axis highlighting the largest demographic reaching the peak age of FTHBs. The right axis in green represents FTHB purchase loan applications per 1,000 individuals in 2023. For example, the highest share of FTHBs is among younger millennials, who are age 27 to 29. Data shows that more than seven of 1,000 total millennials between those ages were FTHBs in 2023.

Younger Millennials Enter the Peak of FTHB Demand

Millennial homebuyer demand is likely to remain strong in the coming years, since this generation represents the largest number of FTHBs, as well as a substantial portion of move-up purchasers. However, there are still many younger millennials under the age of 30 who have yet to own homes.

At the same time, older millennials are more likely to become repeat homebuyers. The share of millennial repeat home purchase applications was 44% in 2023, 10 percentage points higher than that of Generation X.

That said, historically low inventory, sky-high home prices and elevated mortgage rates create affordability challenges for younger homebuyers. And while these headwinds may slow the influx of new millennials and Gen Z, housing demand among these generations should remain strong, especially if affordability improves.

Stay tuned for CoreLogic’s next analysis on FTHB activity, which our Office of the Chief Economist will release in the coming weeks. And remember to bookmark CoreLogic’s Intelligence home page to stay current with the latest housing market data and insights from our team of industry experts.

[1] This analysis is based on all home-purchase mortgage applications, accepted or not, from January 2015 to December 2023. Data excludes investors, second-home buyers and all-cash buyers.

[2] In 2020, the growth in millennial share was more than 5 percentage points from 2019. The additional half of the 2020 jump was likely driven by the COVID-19 pandemic. The increase was also likely accelerated by record-low mortgage rates and the flexibility of remote work.

©2024 CoreLogic, Inc. All rights reserved. The CoreLogic content and information in this blog post may not be reproduced or used in any form without express accreditation to CoreLogic as the source of the content. While all of the content and information in this blog post is believed to be accurate, the content and information is provided “as is” with no guarantee, representation, or warranty, express or implied, of any kind including but not limited to as to the merchantability, non-infringement of intellectual property rights, completeness, accuracy, applicability, or fitness, in connection with the content or information or the products referenced and assumes no responsibility or liability whatsoever for the content or information or the products referenced or any reliance thereon. CoreLogic® and the CoreLogic logo are the trademarks of CoreLogic, Inc. or its affiliates or subsidiaries. Other trade names or trademarks referenced are the property of their respective owners.